Operators are required to submit accommodation tax for the following quarters in 2026:

- Q1 (January 1, 2026 - March 31, 2026)

- Q2 (April 1, 2026 - June 30, 2026)

- Q3 (July 1, 2026 - September 30, 2026)

- Q4 (October 1, 2026 - December 31, 2026)

It is the short-term rental operator’s responsibility to ensure that the correct amount of accommodation tax is paid to the City. If you’ve been notified that your account has a credit, subtract it from the total amount due before paying. The City may revoke your short-term rental licence or deny your licence renewal if you fail to report and pay the accommodation tax.

Application of tax

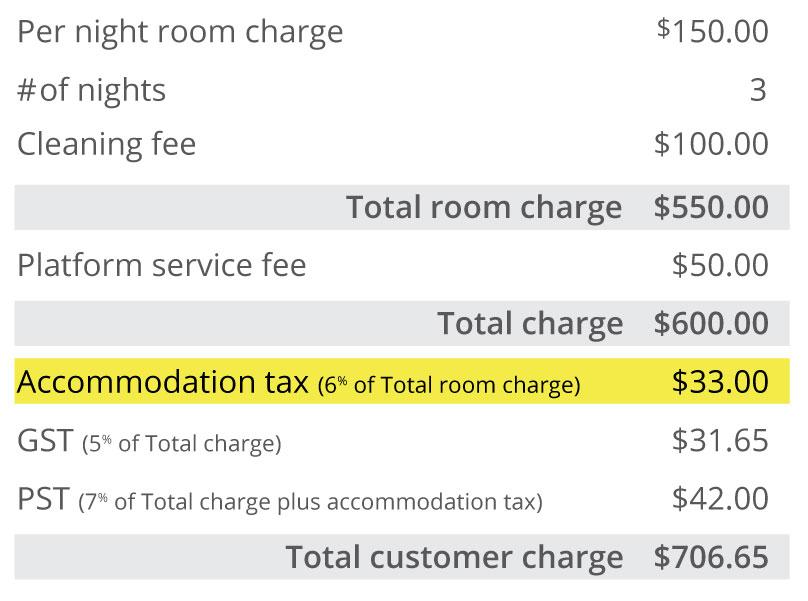

All short-term rental operators are required to charge and collect a 6% accommodation tax on all bookings. Bookings completed prior to April 1, 2024 are not subject to accommodation tax.

The accommodation tax should be charged within the booking platform. Platforms licensed by the City should have this feature enabled to allow operators to add it to their booking.

The amount of the tax must be shown as a separate item or charge on the receipt/invoice.

The 6% accommodation tax is required to:

- Be charged on the full purchase price of the accommodation plus cleaning fees (platform service fees are not subject to accommodation tax)

- Be applied before other taxes such as GST and PST

In the below example, the accommodation tax is calculated to be $33 (six percent of the total charge plus the cleaning fee ($450 +$100 = $550)). Terminology used may vary, depending on the platform.

Please note: PST is not charged on accommodation tax.

Reporting requirements

Operators must submit a quarterly accommodation tax return within 20 days following the quarter end. A report must be filed for each reporting period, regardless of whether or not the property was rented out during that quarter. The return must include:

- The total revenue by month, including cleaning fees and excluding service fees

- The applicable accommodation tax

Using the above example:

- The total revenue reported would be $550

- The accommodation tax would be $33

Filling out your quarterly accommodation tax report

Have the following information ready:

- Government-issued identification used during short-term rental licence application (driver’s licence or photo ID card issued by province or territory in Canada). For first-time reporting only

- Short-term rental licence number (STRA-YYYY-0000000)

- Property roll number for property taxes. Find your roll number by viewing the Property Assessment Details

- Total taxable revenue collected during the reporting period, separated by month and by platform

Vrbo collects and remits accommodation tax directly to the City of Winnipeg. You should still include Vrbo revenue in your report, but it will not be used in the calculation of accommodation tax owing for the period.

Determine the amount owing

- Open the Confirmation of Accommodation Tax Report Submission email you received after submission

- Make note of the amount listed under Total amount due (tax and penalty)

- If you’ve been notified that your account has a credit, subtract it from the total amount due before paying

Paying your accommodation tax

Make payment a few days in advance of the due date to ensure payment reaches the City before the due date.

Pay in person

Pay by cash, debit, or cheque at:

Main Floor – 395 Main Street

Winnipeg, MB R3B 3N8

If paying by cheque, please include the last seven digits of your short-term rental licence number on the cheque. Make cheque payable to the City of Winnipeg.

Pay by mail

Accommodation tax payments submitted by mail must be postmarked within 20 days after the quarter ends to avoid any late penalties.

Pay by cheque:

Licensing & Bylaw Enforcement

Main Floor – 395 Main Street

Winnipeg, MB R3B 3N8

Please include the last seven digits of your short-term rental licence number on the cheque. Make cheque payable to the City of Winnipeg.

Pay online

- Register for bill payments at most banks with the last seven digits of your short-term rental licence number.

- Payee account name: Winnipeg, City of - STRA Accom Tax

Credits

Submitting a correction to a previously filed report can result in you having a credit on your account. When applicable, you will be notified of a credit by email.

Deduct any credits from your total amount due on your next payment.

If you are unsure about your credit amount, contact CMSLicensing@winnipeg.ca.

Penalties

Late payments will be subject to penalties at 2.5% per month beginning on the 21st of the month.

A non-sufficient funds (NSF) charge of $34 will be applied to all accommodation tax payments not honoured by a financial institution due to insufficient funds.

Penalties will be applied automatically to accounts and cannot be waived.

Refunds

The Accommodation Tax By-law does provide the ability for the purchaser to apply for a refund to the accommodation tax paid, if it was paid by or on behalf of an individual or one or more of the individual’s family members during such time as the individual is in Winnipeg to receive medical treatment or to undergo testing at a hospital or Provincially-approved medical facility, or to seek medical advice or treatment from a medical specialist.

For more information on eligibility and the process for applying for a refund: Accommodation Tax Refund Form.xls (winnipeg.ca)