Letter from the Mayor and Chairperson of the Standing Policy Committee on Finance and Economic Development

We are pleased to table the Preliminary 2023 Balanced Budget Update to the 2020-2023 Multi-Year balanced budget.

The Multi-Year Balanced Budget is the City’s core financial blueprint. It has helped us to weather the storm of over $200 million in revenue losses and expenses as a result of the COVID-19 pandemic while protecting critical city services and improving our credit rating with international bond rating agencies.

We embark on this year’s balanced budget update fully aware of the challenges and tough choices that lie ahead. Businesses, residents and the City’s finances continue to be impacted by the pandemic and inflation. However, with the provincial public health orders for the pandemic lifted and signs of inflation easing we are optimistic as to the pace of our City’s recovery in 2023.

2023 is also the first full year of the newly elected Mayor and Council. It is an opportunity to forge a new and collaborative working relationship among all members of Council, our federal and provincial partners and the residents that we serve.

The Preliminary 2023 Balanced Budget Update reflects feedback received by the Chair of Finance and Economic Development from all members of Council. It was developed with recommendations from a four-member budget working group with equal representation from Executive Policy Committee and non-Executive Policy Committee Council members, a contrast to the process from previous years. It also reflects many of the ideas and feedback that we have received from residents, businesses and community stakeholders.

The Preliminary 2023 Balanced Budget Update presents a balanced operating budget for 2023 while keeping taxes affordable and continuing investments in critical infrastructure and services to maintain our quality of life, care for our most vulnerable residents and support a growing City.

Before addressing any new costs related to the COVID-19 pandemic and inflationary pressures we were facing a shortfall of approximately $5.4 million in the tax supported budget for 2023 due to the following:

- $4.2 million for the negotiated settlement with CUPE, increases to CPP and EI rates and other adjustments;

- ~$900,000 for Council approved snow clearing changes in 2022; and

- $253,000 for increases to the Universal Funding Formula for Community Centres due to inflation and population growth.

In 2023 the City will face a COVID-19 related shortfall of $16.5 million in the tax supported budget primarily from reduced transit ridership levels and a lower dividend from the Parking Authority due to lower parking revenues. In 2023 the City will also face an estimated $11.9 million more in fuel costs in the tax supported budget due to increases in the price of fuel on world-wide markets.

The total shortfall in the 2023 tax supported operating budget due to non-discretionary costs is $33.8 million. This includes the non-COVID shortfall of $5.4 million, $16.5 million in COVID costs and $11.9 million in additional fuel costs.

The Preliminary 2023 Balanced Budget Update includes several measures to eliminate the budget shortfall and bring the tax supported operating budget back into balance. More details on these measures can be found in Volume 2 of The Preliminary 2023 Budget Update. However, two of the most significant measures include:

- $22.8 million allocation from the new federal and provincial COVID-19 transit funding, and;

- $10.4 million in reduced expenses, vacancy management and a transfer of capital cost savings from prior years to the 2023 tax supported operating budget.

The Preliminary 2023 Budget Update also includes an efficiency savings target of $33.5 million which will be achieved through draws from reserves and cost savings across various departments. This is a decrease from the $40.6 million of efficiency savings originally included for 2023 in the Multi-Year Balanced Budget.

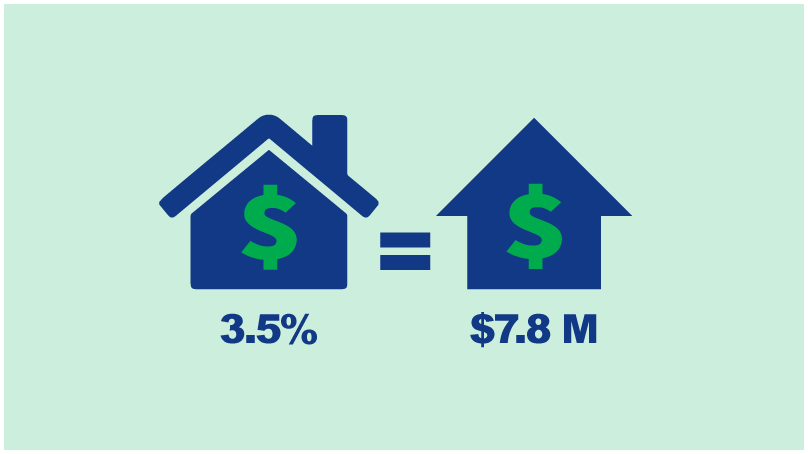

The property tax increase in 2023 will be limited to 3.5 percent. Two percent of this increase will be invested in regional and local road renewal and .33 percent will be dedicated to financing the Southwest Rapid Transitway, consistent with previous years. The remaining property tax increase of approximately 1.17 percent generates an estimated $7.8 million which will support new investments in 2023 including:

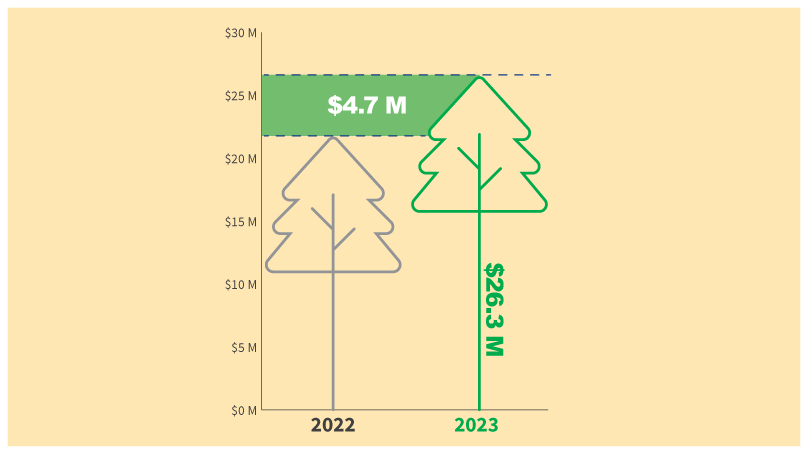

- $3.6 million to protect and renew Winnipeg’s tree canopy. This results in a total operating and capital investment in trees of $26.3 million in 2023, an increase of $4.7 million from last year.

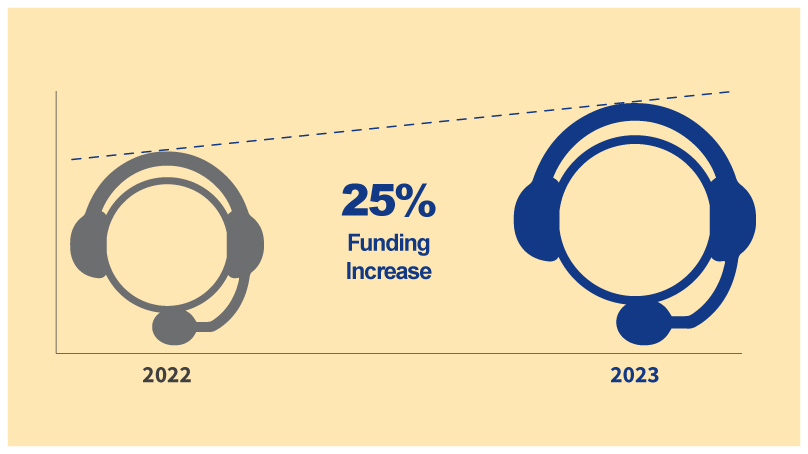

- $1.1 million to increase the budget of 311 Services by 25 percent from 2022 to facilitate the recruitment of new staff and to retain existing staff.

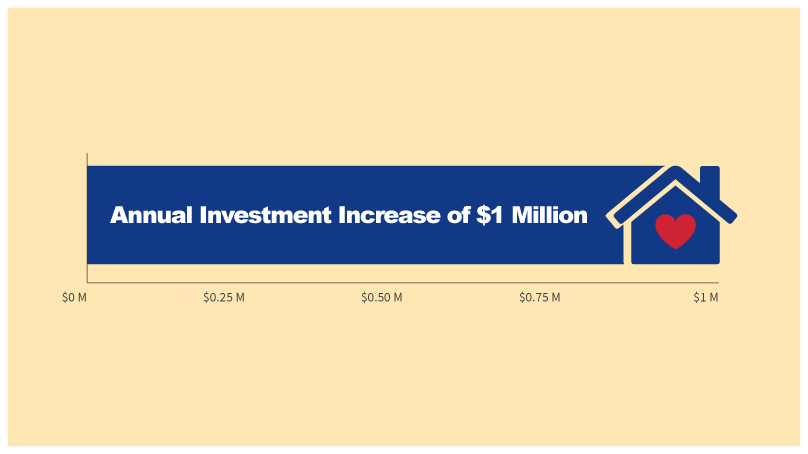

- $1.0 million to support new investments in additional 24/7 safe spaces for unsheltered and at-risk residents.

- $1.0 million to increase transit service to its full service capacity prior to the pandemic, phased in over 2023.

- $450,000 to begin to establish neighbourhood action teams to complement the services provided by Public Works and other city departments.

- $400,000 to restore the annual operating grant to the Winnipeg Arts Council.

- $250,000 continue support for the operations of the Downtown Community Safety Partnership.

The Frontage Levy will be increased by $1.50 per foot from $5.45 to $6.95 in 2023. This generates an estimated $17.8 million annually which will be dedicated to road renewal in 2023, consistent with the requirements of The City of Winnipeg Charter. This additional revenue will support:

- $12 million more for regional and local street renewal;

- $3 million more for active transportation investments attached to road renewal projects; and

- $2.8 million to advance planning and design for the Chief Peguis extension and expansion of Kenaston Boulevard, as a first step in a Trade Corridors renewal strategy.

The property tax increase of 3.5 percent together with the frontage levy increase of $1.50 per foot will result in the average Winnipeg single family homeowner paying $142 more in 2023. This will ensure that Winnipeg’s municipal property taxes remain among the most competitive in Canada. Actual increases will likely be significantly lower for residents of townhouses, condo apartments and other multi-family units, owing to substantially lower per-unit liability for frontage on these properties.

The preliminary 2023 Balanced Budget Update includes an investment of $5 million to launch a new transit safety and security initiative, funded by Provincial COVID-19 transit funding.

The Preliminary 2023 Balanced Budget Update includes an initial investment of $100,000 for the Millennium Library to undertake a safety and security audit and begin the necessary security upgrades to ensure a safe and welcoming environment for patrons and staff at this facility. Further investments in security may be forthcoming pending the recommendations of an ongoing security review.

The Preliminary 2023 Balanced Budget includes a new investment of $150,000 to support consulting services to operationalize the Municipal Service Delivery Agreement for the historic Naawi-Oodena development as well as $282,000 to support three new staff to develop and implement a new Road Safety Strategic Action Plan.

The Preliminary 2023 Balanced Budget Update includes an investment of $488,000 to support four to five more permanent full-time staff within the City’s permit processing department, consistent with Council approved 2022 budget recommendations, to invest increases in permit revenue back into improving the permit service. The Preliminary 2023 Balanced Budget Update also includes a further $2 million investment to maintain temporary staff in the Planning, Property and Development department to ensure timely processing of permits.

Business tax revenue is expected to increase by $1.9 million in 2023. The Business Tax rate will remain unchanged at 4.84% in 2023. The Small Business Tax threshold will increase from $44,220 in 2022 to $47,500 in 2023 as a result of re-assessment which will ensure that approximately 55 percent of all businesses will be exempt from paying this tax which is similar to 2022.

Increases to most City fees and charges will be limited to the rate of inflation of 3.2 percent, 1.2 percent higher than the increase of 2 percent in the multi-year balanced budget. The increase to transit fares will be limited to five cents which is consistent with the multi-year budget.

The 2023 Preliminary Balanced Budget Update also includes new fees to more accurately reflect the cost of City services that do not currently have fees. A complete list of new fees can be found in Volume 2 of The Preliminary 2023 Budget Update.

Overall, the tax supported budget will increase by 7.3 percent in 2023, 4.5 percent higher than the increase in the multi-year budget (2.8 percent). The 2020 to 2023 operating tax supported budget (excluding capital related expenditures) is increasing by an average of 2.2 percent, a slight increase from the 4-year average in the 2022 budget update of 1.3 percent.

Prior to the onset of the pandemic, the FSR had a balance of about $100 million which was above the Council mandated level of six percent of tax-supported expenditures.

The FSR has fulfilled its purpose to stabilize the City’s finances over the last three years of the pandemic. However, the financial impact of COVID-19 and other pressures has significantly depleted the FSR, leaving a current forecasted balance of only $5.2 million which is below the Council mandated level. Conversely, the City’s waterworks utility has incurred a larger than projected surplus during the pandemic mostly due to higher water consumption rates.

To assist in replenishing the FSR, the Preliminary 2023 Balanced Budget Update includes a one-time transfer of $15 million from the retained earnings of the waterworks utility to the FSR. This transfer is incremental to the existing dividend from the water and sewer utility to the tax supported operating budget.

This transfer of $15 million will increase the balance of the FSR but will still leave the FSR below its Council mandated level of six percent of tax-supported operating expenses. Therefore, later in 2023 and/or as part of the 2024 multi-year budget process, the Public Service will bring forward recommendations for Council’s consideration to further replenish the FSR to its required level.

The Preliminary 2023 Budget includes a six-year capital investment plan of approximately $3.1 billion. Key investments include:

- $155.8 million for regional and local road renewals in 2023. This reflects an increase of $18.9 million from the projected level of $136.9 million last year and is part of a six-year $977.4 million investment in road renewals.

- $10.4 million for the protection and enhancement of Winnipeg’s tree canopy in 2023. This is an increase of $4.2 million from the projected level of $6.2 million last year, and is part of a six-year $56.7 million capital investment in the urban forestry renewal program.

- $60 million to provide water and sewer servicing to the first phase of CentrePort South, an increase of $40 million from last year due to new provincial/federal funding support.

- $18 million ($3 million in 2022 and $15 million in 2023) to begin work on a nutrient removal plan for the North End wastewater treatment plant.

- $12.6 million to celebrate Winnipeg’s 150th anniversary by preserving it’s past—an investment in the City’s archival documents and artifacts in the City Archives by beginning work on renovating and returning to the former archives building at 380 William Avenue.

- $10.9 million for a new fire paramedic station in Waverley West in 2024 to be heated and cooled by geothermal technology.

- $22.3 million for the transition to convert the diesel bus fleet to electric and/or hydrogen fuel cell buses with a total $267.8 million over the six-year capital program.

- $2.9 million for the implementation of a Citizen Portal project to improve citizen visibility into the progress of their requests and the first step to continue to improve services.

- $2.0 million for the preliminary design of the East of Red RecPlex, to develop a regional recreation and aquatic facility.

The six-year capital plan of $3.1 billion will be financed by grants from other levels of government of $700.7 million, reserves and frontage levies of $1.8 billion as well as external debt of $275.2 million. The level of external debt in the six-year capital forecast is within the City’s self-imposed debt limits.

The 2023 Balanced Budget Update is the final year of the City’s first ever multi-year balanced budget. We believe that it is a disciplined plan that ensures services are provided at an affordable cost by investing taxpayer dollars responsibly. It is also a plan that recognizes the challenges and opportunities that we collectively face as a City and the investments required to address them.

In 2023 we must remain focused on ensuring we are providing maximum value for taxpayers by continuing to scrutinize all of our expenditures. And, we must also continue to work with our federal and provincial partners to maximize Winnipeg’s share of funding for infrastructure and services that will support our growing city.

The Covid-19 pandemic and related policies created significant disruption for the City of Winnipeg and other municipalities. While provincial and federal governments could use deficit financing and rely on robust consumption tax and growth revenues to pivot out of the pandemic economy, municipalities like Winnipeg have had to rely on emergency reserves, service cuts and assistance from other governments to ride out the storm. With that in mind, Winnipeg is grateful for recent action by provincial and federal governments to invest in city services and in Winnipeg’s recovery on several fronts. Recent confirmation of federal and provincial transfers to compensate for lost transit revenues during the pandemic, recent federal investments in Winnipeg’s tree canopy maintenance and expansion and recent provincial announcements of funding to restore a joint RCMP-Winnipeg warrant unit and to invest in the CentrePort South opportunity are all examples of how the federal and provincial governments are critical partners in the City of Winnipeg’s success.

We now invite all residents and members of Council to continue the discussion to finalize the Preliminary 2023 Balanced Budget Update to the 2020-2023 multi-year balanced budgets.

Multi-Year Budget Preliminary Budget schedule of meetings

Provide feedback on the preliminary budget

If you would like to provide feedback on the preliminary budget in-person, register to appear as a delegation at the appropriate committee.

If you would like to make a written feedback submission for the public record, please submit a copy to City Clerk’s.

The preliminary 2023 Operating and Capital budgets for the City of Winnipeg will be tabled at a special meeting of Executive Policy Committee on Wednesday, February 8, 2023 at 2 p.m.

Following a 23-day period for all City Councillors and the public to review the preliminary budget, the schedule of public meetings to hear delegations and consider changes will be as follows:

Friday, March 3, 2023 - 9:30 a.m.

Standing Policy Committee on Public Works

- Public Works Department - 2023 Preliminary Budget Presentation (PDF, 3.4MB)

- Fleet Management Special Operating Agency 2023 Preliminary Budget Presentation (PDF, 1.5MB)

- Parking Authority Special Operating Agency 2023 Preliminary Budget Presentation (PDF, 1.1MB)

- Winnipeg Transit Department 2023 Preliminary Budget Presentation (PDF, 2.5MB)

Monday, March 6, 2023 - 9:30 a.m.

Standing Policy Committee on Community Services

- Winnipeg Fire Paramedic Service 2023 Preliminary Budget Presentation (PDF, 2.1MB)

- Public Works Department - Parks and Open Space Division 2023 Preliminary Budget Presentation (PDF, 3MB)

- Community Services Department 2023 Preliminary Budget Presentation (PDF, 2.7MB)

- Animal Services Special Operating Agency 2023 Preliminary Budget Presentation (PDF, 2.9MB)

Wednesday, March 8, 2023 - 9:30 a.m.

Standing Policy Committee on Water, Waste and Environment

Thursday, March 9, 2023 - 9 a.m.

Standing Policy Committee on Property and Development

- Planning, Property & Development Department, and Golf Services Special Operating Agency 2023 Preliminary Budget Presentation (PDF, 1.7MB)

- Assets and Project Management Department, and Municipal Accommodations 2023 Preliminary Budget Presentation (PDF, 1.8MB)

Friday, March 10, 2023 - 9:30 a.m.

Winnipeg Police Board

Monday, March 13, 2023 - 9:30 a.m.

Executive Policy Committee - budget presentations

- Organizational Support Services 2023 Preliminary Budget Presentation (PDF, 1.4MB)

- 311 Contact Centre 2023 Preliminary Budget Presentation (PDF, 1.4MB)

- Innovation & Technology Department 2023 Preliminary Budget Presentation (PDF, 1.7MB)

- Council Services 2023 Preliminary Budget Presentation (PDF, 1.5MB)

Tuesday, March 14, 2023 - 9:30 a.m.

Standing Policy Committee on Finance and Economic Development

- Assessment, Taxation and Corporate 2023 Preliminary Budget Presentation (PDF, 2MB)

- Planning, Property and Development Department - Economic Development 2023 Preliminary Budget Presentation (PDF, 1.1MB)

Upcoming meetings

- Thursday, March 16, 2023 - 9:30 a.m.

Executive Policy Committee - budget delegations - Tuesday, March 21, 2023 - 2:30 p.m.

Executive Policy Committee - final budget recommendations - Wednesday, March 22, 2023 - 9:30 a.m.

Council to consider budget

NOTE: Residents are encouraged to check the Council and Committees Schedule of Meetings in case of changes to the scheduled meeting times.

Budget news

Preliminary budget at a glance

Budget subject to Council approval

Key expenditures

Customer service

- An immediate 25% increase in the funding level for 311 to enable recruitment of additional staff and improve retention of existing staff

- $450,000 to begin development of Neighborhood Action Teams to improve cleaning, plowing, and repair of public spaces

- Gradual restoration of transit service to 100% of pre-pandemic capacity over the course of 2023

- Investment of $2.9 million to develop citizen portal

Economic development

- An investment of $2.8 million in trade corridors from the increase to the frontage levy to support planning of the Chief Peguis Trail extension and Kenaston widening

- Provincial announcement to add $40 million to the previously budgeted water and sewer work in CentrePort South

- Business Tax rebate threshold expanded to keep 55% of the businesses of the rent-based business tax roll

- $400,000 to fully restore the annual grant to the Winnipeg Arts Council

- Funding for consultant contract to begin operationalizing Naawi-Oodena

- Investment in permits staff

Investments in infrastructure and natural assets

- An investment of $26.3 million (capital and operating) in Winnipeg’s tree canopy in 2023, a $4.7 million increase from 2022

- An investment of $12.6 million to build a new centre for Winnipeg’s Archives to be located in the Carnegie building on William Avenue

- An investment of $155.8 million in road renewals in 2023, which is an $18.9 million increase from the forecasted level funded by the frontage levy increase. Part of a 6-year investment of over $977.4 million in road renewals

- $18 million ($3 million in 2022 and $15 million in 2023) to begin work on a nutrient removal plan for the North End Wastewater treatment plant

- An investment of $17.6 million in active transportation projects, an increase of $8 million from the forecasted level (ref: appendix 6 of the 2022 supplement) which is funded by the increase to the frontage levy

Community outreach/ safety/humanitarian

- An annual investment increase of $1 million in additional 24/7 safe spaces for unhoused people

- Annualized grant funding of $250,000 for the Downtown Community Safety Partnership

- City deployment of Provincial transit funding to launch a new transit security initiative, details to be confirmed soon

- Funding of 3 new FTE’s to support the development of a Road Safety Action Plan

Key revenues

Property tax

Property tax increase is at 3.5% which adds $7.8 million

Frontage fees

Frontage fees increase of $1.50/foot which generates $17.8 million

Business taxes

Business taxes % is unchanged, 55% of business will still pay no tax, but overall increase above the original budget of $1.9 million

One-time transfer

One-time transfer out of Water & Waste for $15 million to the Financial Stabilization Reserve

Other transfers

Transfers from Insurance Reserve, Insect Control Reserve, Southwest Rapid Transit Reserve and other reserve funds

Pandemic-related funding

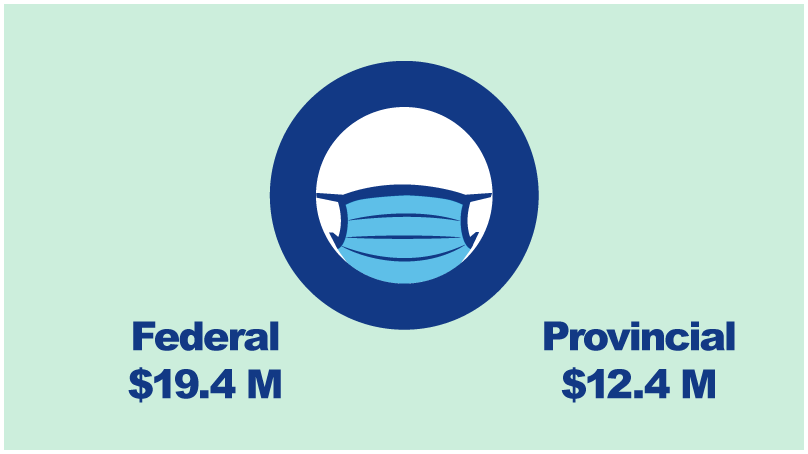

Pandemic-related funding from the Federal Government $19.4 million and the Provincial Government estimated to be $12.4 million allocated as follows:

- $9 million to Transit in 2022 to cover existing over-expenditure draw from General Revenue Fund

- $5 million to Transit in 2023 to be allocated to safety and security

- $17.8 million to General Revenue Fund to set the impacts of COVID and other resulting cost pressures