Letter from the Mayor and Chairperson of the Standing Policy Committee on Finance and Economic Development

It is our honour to present the Preliminary 2024-2027 Multi-Year Balanced Budget. This is the second four-year balanced budget in Winnipeg’s history, and it is the product of months of work between the City Public Service, and City Councillors from both the Executive Policy Committee and the Budget Working Group. Both groups reviewed written submissions from members of Council at-large on ward priorities, and the draft also includes new investments in several priorities identified in the Strategic Priorities Action Plan adopted by City Council in 2023.

City Councillors, the City’s many partners and Winnipeg residents should consider several broad issues when reviewing this draft budget.

Canada’s average inflation rate throughout 2023 was 3.9%, and the year-over-year rate tracked in December was 3.4%. To counter this, the Bank of Canada’s Policy Rate is at 5%, which is higher than at any point since the mid-2000s. This means significantly higher monthly costs for Winnipeg families renewing mortgages or trying to buy a home in this budget cycle. The cost of developing rental housing is higher than many builders – including non-profit builders of social and affordable housing – had planned due to rising financing costs. Meanwhile, the final federal deadline for repayment of Covid-era small business (CEBA) loans was on January 18th, just weeks ago.

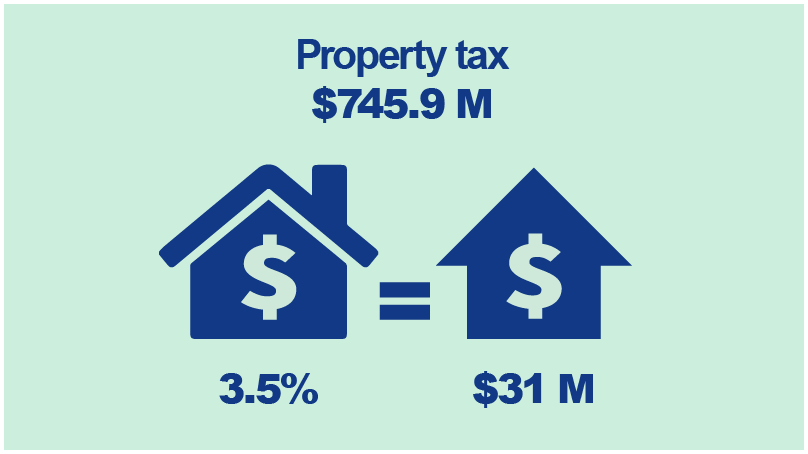

Most Canadian local governments have no revenue streams that grow with the economy. In this environment, local officials in other cities have faced difficult choices, since service expectations are rising, and inflation is driving up the cost of basic municipal services. Many cities have chosen to enact substantial property tax increases, as high as 5-10%, and some have done so for their second year in a row. However, in keeping with the Mayor’s 2022 campaign platform, the Preliminary Budget is holding to a 3.5% property tax rate increase throughout the 2024-2027 plan to help residents and businesses maintain cost stability. In line with Council’s prior commitments, two percent of this increase in 2024 is dedicated to maintaining our record pace of investment in road repairs, as part of almost $1 billion in investments in roads over the six-year $3.3 billion capital plan.

As of 2024, this will mean that a typical Winnipeg homeowner will now be paying less in municipal property tax – including frontage levies – than the owner of a comparable home in every other major city in Canada. Holding to 3.5% will also allow property taxpayers to see the full impact of provincial education tax cuts when the Manitoba government includes rebates on the tax bill this year.

However, the City will still need more revenue in the years to come, both to protect service levels and to modernize operations, software and equipment. With this in mind, we continue to seek growth revenue options and transfer reforms through collaborative discussions with our partners at the Province of Manitoba. The Preliminary Budget also includes four other revenue measures to help address higher costs, as listed below.

City reserves were expended during the Covid-19 emergency, and the Financial Stabilization Reserve (FSR) was depleted entirely. As of year-end 2023, the FSR is still below $10M. Meanwhile, City departments are facing tough challenges with higher costs – and our plan asks these departments to manage their budgets tightly for one more budget cycle, with a combined corporate efficiency target of over $30M for 2024 and new savings targets for the Fleet Management Agency.

The clearest example of our cost and revenue challenge is in Transit. With lower post-Covid ridership, cuts to provincial grants in 2017, and changing rider purchasing patterns, property tax subsidies to Transit have become one of the fastest growing expenses in the budget. Winnipeg property taxpayers are paying $30 million more per year in operating subsidies than we expected in our 2020 projections.

Most importantly, Transit is on-track to shift to a new high frequency schedule in 2025. Community Safety Officers for Transit are funded through to 2027, and the capital budget includes funding to upgrade Winnipeg’s PEGGO system to improve the ridership experience. The Preliminary Budget finances four new transit routes in Northwest and Southeast Winnipeg to ensure new neighborhoods are tied in to the improved system. Funding was also added to help Winnipeg Transit hire and train more new bus operators faster to reach full service levels.

To address cost pressures, the Budget proposes four new revenue measures:

- The 2024-2027 plan incorporates fee increases to catch up with inflationary growth after the Covid-19 Pandemic – but the Preliminary Budget also caps the one-year increase for most fees at 5% in any of the next four years to minimize impacts on residents.

- Transit fares will rise ten cents at the beginning of each calendar year over the four years of the Plan to support the new service improvements.

- The plan includes an increase in Accommodations Tax by 1%. Formulae for use of this tax are adjusted to freeze Economic Development Winnipeg’s grant at 2023 levels, and shift funding to invest more in city beautification and security. $0.5m in additional Special Event Marketing Fund investments are booked for 2024, and further action will be taken this spring to reform and enhance the Special Event Marketing Fund, as confirmed in the budget recommendations.

- Cost increases to operate Winnipeg’s 911 system are in the millions, and the capital cost of mandatory improvements to create “Next-Generation 911” is currently projected at over $10M. The Canadian Radio-Television and Telecommunications Commission (CRTC) has mandated a national shift to Next-Gen 911 service levels in order to ensure that 911 users can “send texts, videos and photos. We want to ensure that emergency services benefit from these advancements.” For example, Next-Gen 911 would allow callers to send onsite video of an incident in progress to Police, or to forward medical information in an emergency to assist first responders.

Most provinces have a provincial or municipal 911 charges on phone bills to finance their 911 system, and – unlike Winnipeg – most major Canadian cities do not carry the cost of 911 emergency response directly in their budgets. The 2024-2027 plan takes the first steps to create a new 911 charge of $1 per monthly phone bill on phones registered to Winnipeg addresses, which would be 100% dedicated to 911 capital and operating costs if approved. The Budget also proposes to start work on an amalgamation of Police and Fire-Paramedic 911 systems to improve 911 operating efficiency.

An additional $1.25M is in the Preliminary 2024 Budget to support the Mayor and Council’s commitment to reduce 311 wait times. The Preliminary Budget also increases the snow clearing budget significantly for the first time since the mid-2010s. It invests in library hours and library security, and funds the launch of a new library in Northwest Winnipeg that had previously been deferred. Funding is included in the budget to field three new Neighborhood Action Teams by year-end 2027. In order to support forthcoming CentrePlan 2050 objectives, a new Downtown Arts Capital Fund will support capital investments by major arts institutions. Council will also soon be debating a proposed new mandate for CentreVenture – likely targeted at Downtown housing – and funds are budgeted to support this objective.

The Preliminary 2024-2027 Budget also accelerates modernization of the City’s aquatic sport and recreation facilities, in line with Council-adopted strategies. It proposes to phase out more wading pools (which are costly to maintain and operate) and close three pools that are approaching the end of their structural/operational life. These steps are balanced with increased spray pad construction and investments in new recreation facilities. At the ward level, Councillors can also now access a new $2M (citywide total) annual Communities Fund to support neighborhood recreation or community improvement projects, provided they do so in compliance with existing Parks and Recreation Enhancement Program (PREP), Community Incentive Grant Program (CIGP) or Per Capita grant requirements. This funding is over and above other PREP and ward funding.

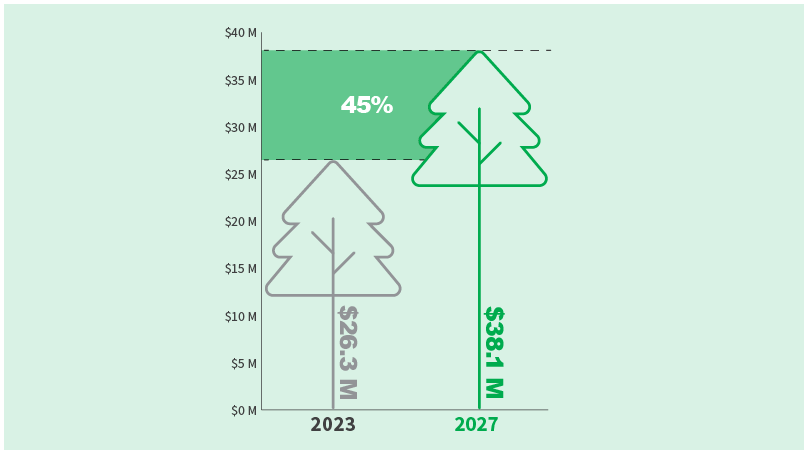

Finally, in line with Council’s unanimous support of increased tree canopy investments as a strategic priority, the urban forestry budget is growing by 45% over the life of the plan, with sufficient funding in earlier years to ramp up pruning to reach the 7-year/12-year pruning cycle target. Larger funding increases in 2026 and 2027 will support faster planting strategies, after the City’s Public Service has had time to scale up planting plans and capacity.

Council adopted multi-year balanced budgeting to bring more consistency and strategy to financial planning. However, shortly after the first balanced multi-year budget was adopted, the pandemic created the single greatest disruption to City operations since the 1950 Flood. The previous Multi-Year Budget was adjusted several times in the years that followed as a result.

In that spirit, several key priorities from SPAP are not yet financed in the 2024-2027 plan, and each will require future budget adjustments, with dedicated financing or offsets. These priorities include:

- Trade corridor improvements adopted as SPAP priorities (Chief Peguis Trail and Kenaston-area improvements). Notably, in 2022, the Mayor committed that new (2023) frontage levy revenues now allocated to general road repair would be diverted to finance trade corridor projects if matching Federal and/or Provincial funding becomes available for those projects.

- Rehabilitation/replacement of the Arlington Bridge, a SPAP priority. Decisions on this subject are deferred, pending ongoing structural studies.

- 2023 initiatives to assist with homelessness are funded through 2024. However, the budget does not reflect long-term funding of these initiatives beyond 2024, pending ongoing discussions with the Province of Manitoba and key stakeholders about the timing, scope and strategy for a shift from the current outreach model to a more aggressive Housing First model.

- Potential costs related to Portage & Main Concourse repair and potential related expenses remain unbudgeted, pending a Public Service report.

- Housing Accelerator Funding is included in the 2024-2027 Plan, but not fully allocated pending further development and approval of a program budget that reflects the actual $122M award from the Government of Canada. To support City housing objectives Downtown, preliminary operating funding for CentreVenture is included in the budget.

- Funding for two major SPAP-backed environmental initiatives - compost collection, and green retrofits of City buildings - is not yet included in the plan.

In all of these cases, Winnipeggers should expect further in-year or annual budget updates as needed to address them in 2024-2027. Additional changes may also be made to invest further in City priorities – like accelerated tree planting, to name just one example – if new revenues are available in future fiscal years.

We would like to take this opportunity to thank the City of Winnipeg’s partners in the Province of Manitoba and the Government of Canada. Strong partnerships bode well for Winnipeg’s success in the years to come. Our city faces important challenges, but there is also a growing consensus among governments on the strategies needed to solve them. Our ability to solve problems, seize opportunities and stand tall among our peers depends in large part on our ability to row together toward shared goals wherever and whenever we can.

Councillors engaged in the budget process – be it in the Budget Working Group, Executive Policy Committee or Council-at-large through various submissions and discussions – have all made compromises to reach this point. We are confident that together, we have produced a balanced Multi-Year Budget that will leave Winnipeg strongly positioned for positive change in the years to come.

Scott Gillingham

Mayor

Jeff Browaty

Chair, Standing Policy Committee on Finance and Economic Development

Multi-Year Budget Preliminary Budget schedule of meetings

Provide feedback on the preliminary budget

If you would like to provide feedback on the preliminary budget in-person, register to appear as a delegation at the appropriate committee.

If you would like to make a written feedback submission for the public record, please submit a copy to City Clerk’s.

The preliminary 2024-2027 multi-year balanced Operating and Capital budgets for the City of Winnipeg will be tabled at a special meeting of Executive Policy Committee on Wednesday, February 7, 2024 – 2 p.m.

After the tabling of the budgets on February 7, 2024, the schedule of public meetings to hear delegations and consider the preliminary 2024-2027 Operating and Capital budgets include:

Friday, March 1

Standing Policy Committee on Public Works

- Public Works Department 2024 Preliminary Budget Presentation (PDF, 5.3MB)

- Fleet Management Special Operating Agency 2024 Preliminary Budget Presentation (PDF, 1.4MB)

- Parking Authority Special Operating Agency 2024 Preliminary Budget Presentation (PDF, 2.3MB)

- Winnipeg Transit Department 2024 Preliminary Budget Presentation (PDF, 2.3MB)

Friday, March 8

Standing Policy Committee on Finance and Economic Development

- Assessment, Taxation and Corporate 2024 Preliminary Budget Presentation (PDF, 1.4MB)

- Economic Development 2024 Preliminary Budget Presentation (PDF, 1.2MB)

Friday, March 8

Winnipeg Police Board

Monday, March 11

Standing Policy Committee on Community Services

- Fire Paramedic Service 2024 Preliminary Budget Presentation (PDF, 2MB)

- Public Works Department 2024 Preliminary Budget Presentation (PDF, 2.9MB)

- Community Services Department 2024 Preliminary Budget Presentation (PDF, 9.8MB)

- Animal Services Special Operating Agency 2024 Preliminary Budget Presentation (PDF, 1.8MB)

- Arts, Entertainment and Culture (City Clerks) 2024 Preliminary Budget Presentation (PDF, 1.2MB)

Tuesday, March 12

Executive Policy Committee - budget presentations

- Chief Administrative Office 2024 Preliminary Budget Presentation (PDF, 1.4MB)

- Innovation & Technology 2024 Preliminary Budget Presentation (PDF, 1.7MB)

- 311 Contact Centre (Customer Service and Communications) 2024 Preliminary Budget Presentation (PDF, 1.3MB)

- Council Services 2024 Preliminary Budget Presentation (PDF, 1.5MB)

Wednesday, March 13

Standing Policy Committee on Property and Development

- Planning, Property and Development, Golf Services Special Operating Agency 2024 Preliminary Budget Presentation (PDF, 2.5MB)

- Assets and Project Managements, Municipal Accommodations Division, 2024 Preliminary Budget Presentation (PDF, 1.6MB)

Thursday, March 14

Standing Policy Committee on Water, Waste and Environment

Additional meetings

- Friday, March 15

Executive Policy Committee - Budget delegations - Tuesday, March 19

Executive Policy Committee - Final budget recommendations - Wednesday, March 20

Council to consider budget

NOTE: Residents are encouraged to check the Council and Committees Schedule of Meetings in case of changes to the scheduled meeting times.

Budget news

- City of Winnipeg Unveils Balanced and Strategic 2024-2027 Budget Plan

February 7, 2024 - Preliminary City Budget to be Released on February 7th

January 9, 2024 - Rising Transit Operating Subsidies Pose Challenge for City's 2024-27 Budget

December 14, 2023 Budget Challenges Ahead: Winnipeg Prepares for a Demanding Multi-Year Financial Plan

December 6, 2023

* Subject to Council approval

The downtown

- Neighbourhood Action Teams – 16 FTEs in 2024 increasing to 45 by 2027

- Investment of $4.3 million in Parks

- Operating funding for Downtown Community Safety Partnership and Downtown Biz

- Youth programming funding for the Downtown Y

- Funding for 24/7 Safe Spaces and mobile outreach

- Downtown Arts Capital Fund of $500,000 annually to assist major arts institutions

- Operating funds for CentreVenture pending Council approval of a renewed mandate

A strong economy

- Business tax rate frozen to 2022 levels

- Continued support for Naawi-Oodena development

- Increase of 10 FTEs in 2024 and to 38 by 2027 to improve the permitting process

- Additional $12 million investment for water and sewer work in CentrePort South industrial lands

- A one-time $500,000 increase to the Special Event Marketing Fun

A livable, safe, healthy, happy city

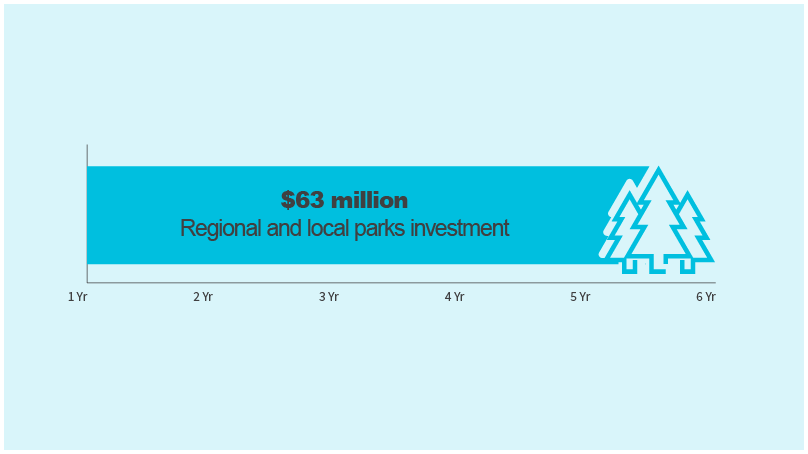

- Regional and local parks investment of $63 million over six years

- Spray pad investment of $20 million over five years

- New Northwest Library and increased library hours for an overall increased investment of $5.9 million

- Investment in recreational facilities for improvements, upgrades, and studies

- Funding for community safety teams

- $200,000 in community safety plan funding

A green and growing city with sustainable renewal of infrastructure

- A further investment of $24.6 million in Winnipeg’s tree canopy in 2024 increasing by almost 45% (to $38.1 million) by 2027 (in comparison to 2023 $26.3 million)

- An investment of $138 million in road renewals in 2024 for a total 6-year investment of over $984 million in road renewals

- An investment of $31 million in the Pedestrian and Cycling Program over six years

- Increased investment of $1.3 million for road safety improvements in 2024 for a total 6-year investment of over $30 million

- An increased transit subsidy from $102 million in 2023 to $133 million in 2027, including four new routes and fare collection systems upgrades

- $3 million per year for riverbank stabilization

A city that works for residents through improved customer service

- Additional $1.25 million in 2024 to continue to get 311 call wait times down

- Increase in snow clearing budget

- Funds to upgrade the decision making information system, NG911, and other important programs to improve customer service and efficiency for the workforce

Key revenues

Property tax

Property tax increase maintained at 3.5% over four years, which adds $31 million in 2024

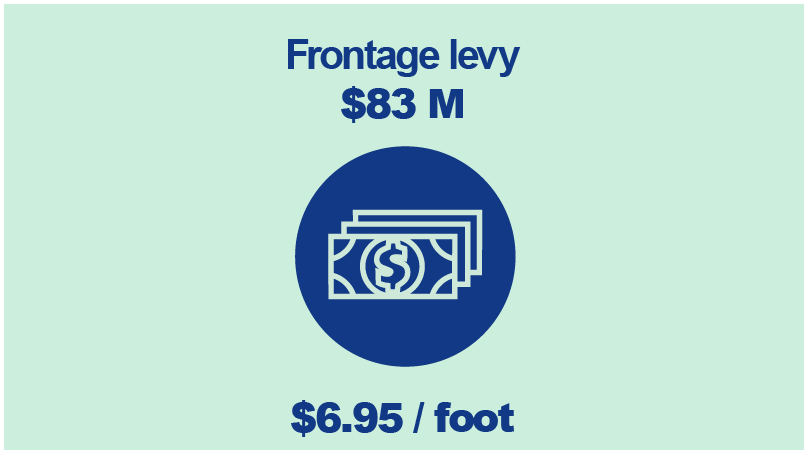

Frontage levy

Frontage levy maintained at $6.95/foot which generates $83 million

Business tax

Maintaining business taxes at 4.84% and the Small Business Tax Credit threshold of $47,50

New revenue sources

- 911 monthly fee of $1 per phone line starting mid-2024

- Accommodation tax increase of 1% in 2024

- Other fees and charges increase annually by 5.0%, 5.0%, 2.5%, and 2.5%

- Four year water and sewer rate increases of 3.8%, 6.4%, 5.2%, and 5.2%

Federal funding

Housing Accelerator Fund $122 million over four years

Provincial funding estimate

- General funding – $141.4 million

- Police funding – $30.4 million

- Other funding – $64.6 million